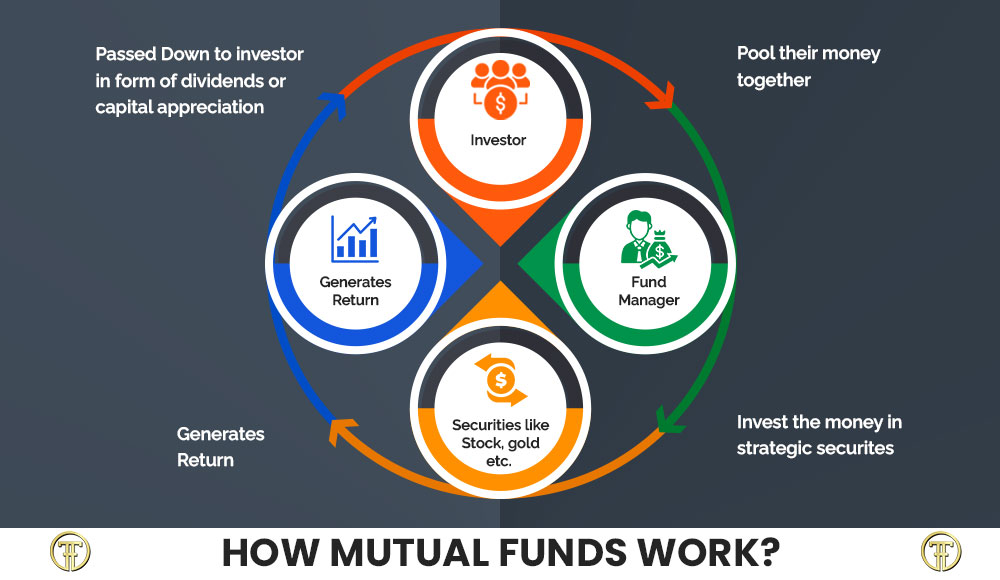

Investing isn’t just for experts anymore. Anyone can invest – whether you have Rs. 500 or Rs. 50 crore. Mutual funds pool your money with other investors and create a powerful collective investment fund that unlocks diverse investment opportunities.

Professional portfolio managers watch and adjust these investments based on market conditions. They take care of everything from stock selection to risk management, letting you focus on your regular work.

Starting to invest might feel overwhelming at first. Mutual funds provide a well-laid-out approach through various options. Conservative debt funds and aggressive equity funds are designed to match your risk tolerance and investment goals.

Want to invest like the pros? Let’s explore how mutual funds work and help you make your first smart investment move.

What Makes Mutual Funds Different

Mutual funds are different from other investment options because of their structure and how they’re managed. These unique features make them appealing to investors at every level.

Pooling Money with Other Investors

The foundations of mutual funds come from their collective investment approach. Your money combines with funds from many other investors when you invest. This creates powerful advantages for individual investors.

You get access to investments usually meant for big investors through pooling. The combined buying power helps reduce costs for each rupee invested. To name just one example, you share the costs with other investors in the fund instead of paying separate fees to buy hundreds of stocks.

You own units or shares of the fund that represent your slice of the entire investment portfolio. The returns or losses match your investment size, which ensures fair distribution among investors.

Professional Management Benefits

Professional management brings unmatched expertise to your investment experience. Fund managers and their analyst teams take care of all investment decisions. These experts spend their time:

- Researching market opportunities

- Selecting appropriate securities

- Monitoring portfolio performance

- Rebalancing investments to meet fund objectives

Professional management proves valuable especially when you have complex market situations. Fund managers have the expertise and resources to make smart investment choices that line up with the fund’s goals. Their teams watch market movements and adjust the portfolio as needed.

You benefit from the fund manager’s knowledge and focus instead of spending endless hours researching stocks or bonds. This professional oversight protects your investments through smart decisions and strategic adjustments.

The management team handles everything in administration, including:

- Record-keeping

- Tax reporting

- Dividend distribution

- Portfolio rebalancing

- Risk management

Mutual funds operate under strict SEBI regulations that ensure transparency and protect investors. These regulations add extra security to your investments, making mutual funds a well-laid-out choice for both new and seasoned investors.

Core Parts of a Mutual Fund

The core components of mutual funds help us understand how they really work. Let’s take a closer look at the key elements that make these investment vehicles work.

Net Asset Value Explained

Net Asset Value (NAV) measures a mutual fund’s worth. Each trading day ends with NAV calculations that show the per-unit market value of all investments minus liabilities. The calculation is simple – just divide the fund’s net assets by the total number of outstanding units.

Here’s a simple example: A mutual fund’s securities worth ₹200 lakh with 10 lakh units of ₹10 each will have a NAV per unit of ₹20. This daily calculation gives you a precise way to track your investment’s performance.

Fund Manager’s Role

Fund managers drive mutual fund operations forward. These investment experts handle several key responsibilities:

- They research and select appropriate securities

- They manage portfolio risk to match fund objectives

- They keep track of market trends and economic factors

- They make strategic investment decisions

Fund managers earn their compensation through a percentage fee based on the fund’s average assets under management (AUM). Their expertise brings great value as they oversee mutual funds, pension funds, and trust funds. This gives investors peace of mind that professionals manage their money.

Types of Securities Inside

Each fund’s portfolio looks different based on its objectives. Most mutual funds mix these components:

- Stocks: These represent ownership in companies and can bring profit through price appreciation

- Bonds: These debt instruments give regular interest payments and return principal at maturity

- Cash Equivalents: These short-term, highly liquid investments add stability

- Commodities: Physical goods like gold or oil respond to supply-demand dynamics

Some funds employ derivatives to manage risk or boost returns. The portfolio mix shows the fund manager’s investment strategy and changes periodically based on market conditions and fund objectives. This diverse mix of securities helps mutual funds create a balanced investment approach that matches different investor goals.

How Money Grows in Mutual Funds

Mutual funds help build wealth through multiple channels that create a strong pathway to financial growth. Let’s explore how your investments can flourish.

Capital Appreciation Path

Your investments grow in value through capital appreciation as market prices rise. Companies in your fund’s portfolio boost their stock prices through good performance, which increases the fund’s Net Asset Value (NAV). To name just one example, see how purchasing fund units at ₹10 that later rise to ₹12 gives you a ₹2 gain through capital appreciation.

These factors accelerate this growth:

- Favorable economic conditions that boost corporate earnings

- Developments in specific sectors that enhance asset values

- Companies merging or getting acquired at premium prices

Dividend Income Stream

Mutual funds provide income through dividend distributions alongside capital appreciation. Fund houses collect investment profits and distribute most to investors after keeping some portion. These payments must happen yearly at minimum, though some funds choose monthly or quarterly distributions.

You can pick between two options:

- Dividend Payout: Get regular cash distributions

- Dividend Reinvestment: Your dividend earnings automatically buy more fund units

Compound Growth Effect

Compound growth substantially increases your mutual fund returns. This happens when you reinvest earnings so they generate extra returns. The money you invest early grows the most since it compounds longer.

A monthly SIP of ₹10,000 with 12% annual returns could grow this way:

- After 5 years: ₹8.2 lakh (37% returns)

- After 15 years: ₹50.5 lakh (180% returns)

- After 30 years: ₹3.5 crore (881% returns)

You can maximize compound growth by:

- Beginning investments early

- Contributing regularly

- Putting dividends and capital gains back into investments

Starting Your First Investment

Your first step into mutual fund investing needs careful thought about your financial goals and a clear grasp of the investment process. Let’s look at how you can begin your investment experience effectively.

Choosing the Right Fund Type

Your risk tolerance and investment timeline need assessment before you start. New investors often find these fund types suitable:

- Large-cap Equity Funds: These invest in prominent companies and offer relatively lower volatility

- Balanced Funds: These provide a mix of equity and fixed-income instruments that create a balanced approach to risk and returns

- Debt Funds: Conservative investors who want regular income will find these ideal

The fund selection process should focus on:

- Investment horizon and financial objectives

- Fund manager’s expertise and track record

- Expense ratio and associated costs

- Past performance analysis

Opening an Investment Account

The process of opening an investment account becomes straightforward once you’ve picked your fund type. You’ll need these mandatory items:

- Valid PAN card

- Bank account

- Completed KYC documentation

Several channels exist to start your investments:

- Online Platforms: AMC websites or mobile applications allow direct investments through account creation

- Bank Services: Your bank’s wealth management services can help with mutual fund investments

- Financial Intermediaries: AMFI-registered distributors can guide your investment decisions

You can choose between these investment methods:

- Lump Sum: This works best when you have a substantial amount ready to invest

- Systematic Investment Plan (SIP): Fixed periodic investments help you benefit from rupee cost averaging

Most mutual funds keep their minimum investment requirements low, usually between ₹500 and ₹5,000. Online platforms let you complete everything – from account opening to your first investment – without visiting any physical location.

Your bank account should be linked to the investment platform. Setting up automatic payments for SIP investments will ensure smooth transactions and help maintain investment discipline throughout your experience.

Conclusion

Mutual funds are a great way to get professional management and diversified investments to build wealth. These investment vehicles connect you with expert fund managers who handle complex decisions while you focus on your goals.

Your money can grow through capital appreciation, dividend income, and compound returns. You can access professionally managed portfolios that align with your risk tolerance and timeline with just ₹500.

Mutual funds make investing accessible to everyone by providing diversified portfolios and expert management. Your investment trip can begin today with basic steps like completing KYC and opening an account. You can choose large-cap equity funds for stability or balanced funds to get moderate growth.

It’s worth mentioning that your fund choices should match your financial goals. You’ll succeed by staying disciplined with SIPs and letting compound interest work its magic over time. The key is to start small and stay consistent – your wealth will grow steadily.